CONGRATULATIONS for buying The Cannabis Investor’s Bible!

Now, simply follow these simple instructions to set up SEVEN cash windfalls of up to $115,000 each RIGHT NOW:

SEAN: Thank you!

As Confucius once said, “The Gods cannot help those WHO FAIL to seize great opportunities.”

Right now, we are all being presented with what is clearly the single greatest wealth-building opportunity of our generation.

And you have taken the first step towards turning this opportunity into wealth.

You have ordered your copy of my Cannabis Investor’s Bible.

And your timing could NOT be better.

Cannabis is already legal for medical use in 33 states plus Washington D.C.

It’s also legal to sell cannabis for recreational use in ten states as well as the District of Columbia.

Plus Minnesota, Missouri, Nevada, North Carolina and Ohio — and even individual cities like Sarasota, Florida — aren’t waiting for full legalization:

They’ve already reduced cannabis possession to a misdemeanor with only a small “slap on the wrist” — in many cases, a fine of $100 or even less.

So it’s no surprise that, as this legalization juggernaut continues to roll across the country, cannabis stocks are posting almost obscene profits for investors.

My own model has already identified cannabis stocks that soared 1,117% … 1,572% … 3,293% … up to 4,627%.

At that rate, every $10,000 you invest turns into more than $470,000.

And every $25,000 becomes nearly $1.2 million.

So here’s my question to each of you:

Are you rich yet?

My mission is to help each and every one of you take full advantage of the most profitable megatrend of our lives.

I’m going to show you why this is the very best time ever to invest in the stock of legal cannabis companies.

I will walk you through my complete Cannabis Stock Scoring System and show you, step-by-step, how it works:

How it has allowed me to identify select cannabis stocks just before they soared as much as 4,627%.

Plus, I’ll show you how, investors following my approach could have turned every $30,000 invested into $1.4 million in just three years.

You could have even withdrawn $20,000 per month after two years and STILL made that $1.4 million!

I’ll also tell you all about the cannabis stocks you should seriously consider buying right now; today …

And why I believe my #1 pick is destined to become the “Apple” of the cannabis space:

The world’s largest marijuana company and the most profitable weed investment ever.

Finally, to demonstrate how powerful this approach really is, I’ll introduce you to everyday investors who say my cannabis investment strategy made them up to $109,000 richer in as few as four weeks.

First though, there’s something you should know about me:

Unlike other analysts who only dabble in cannabis stocks, I’m obsessed with them and have been for years.

Some even say I was the very first investment analyst in America to fully recognize just how profitable cannabis investing could be.

Long before Colorado, California, Nevada, 30 other states and Washington DC made medical Marijuana legal …

Before ten other U.S. states plus DC legalized weed for recreational purposes …

And way before Canada legalized cannabis on a nation-wide basis …

I practically begged my followers to stake their claims in this modern-day gold rush.

And ever since, my cannabis recommendations could have made crazy amounts of money for investors.

Here’s a great example: An actual Trade Alert I sent to my readers.

In this ONE alert, I tell them to take a 107% profit on Leafbuyer Technologies — a double …

A 144% profit on Aphria — nearly two and a half times your money.

A 193% profit on Canopy Group … almost triple your money

A 216% profit on Cronos Group — that’s MORE than a triple …

A 309% profit on Emerald Health Therapeutics — more than a quadruple …

And just look at Future Farm Technologies: A 468% profit!

Anyone who invested $2,500 in that trade could have walked away with nearly $14,200!

Now remember: All of these profits came from just ONE trade alert.

And as you might expect, given these outsized profits, “Thank-You” notes are pouring in from all across America:

Gary B. of Arkansas wrote to say the Future Farms play I gave him soared over 497%.

Others soared 100%, 200% and 300%.

“These were the most profitable trades I’ve made,” Gary says!

“These were the most profitable trades I’ve made,” Gary says!

Madeline C. of Atlanta wrote to thank me for the 392% profit I helped her earn:

“I invested $7,918 and walked away with $26,989,” Madeline says!

“I invested $7,918 and walked away with $26,989,” Madeline says!

And Steven T. of Riverside, Illinois says,

“I never thought I would say this, but I’m up $24,000 in 4 months. Wow!”

“I never thought I would say this, but I’m up $24,000 in 4 months. Wow!”

Here’s a letter from Tom S. — he says he’s writing to thank me for the 159% profit he just earned in Aphria …

He’s also thanking me for the 217% profit I helped him earn in Canopy Growth …

And the 225% profit I helped him earn in Cronos …

And the 406% profit I helped him bank in Emerald …

And ALSO the 529% profit I helped him earn in Future Farms.

So every $2,500 invested becomes $15,750.

Here’s another thank-you note. This one’s from Igor.

He says he made 179% on one trade …

Plus a 229% profit on another play …

A 315% profit on a third trade …

And a 492% profit on a fourth position.

Meanwhile, Neal D. says, “My marijuana portfolio is up $109,000 in four weeks!”

But these are NOT our best possible plays — not by a country mile!

My model has also identified cannabis stocks that soared 1,117% …

Plus, if you could have followed my model, you could have profits of up to 4,627%!

And I’m telling everyone I meet, “You ain’t seen nothin’ yet!”

More money will be earned and more cannabis millionaires created between now and New Year’s Eve, 2020 than ever before.

In fact, no fewer than SEVEN professional studies and reports now confirm that the profits cannabis investors have seen so far are only a tiny drop in a massive sea of money.

This one, published by the Associated Press, says the amount of money invested in cannabis companies is now DOUBLING every 12 months!

Cannabis investing is DOUBLING every 12 months!

– Associated Press

And we all know what that means — more money chasing these stocks can only drive them through the roof.

And that adds up to huge profit opportunities for you — IF you own the right cannabis stocks.

Plus, two more authorities — Arcview Market Research and BDS Analytics — report that cannabis revenues will TRIPLE to $31.3 billion by 2022.

Cannabis revenues will TRIPLE within two years!

– Arkview Market Research & BDS Analytics

But guess what? $31 billion is only the beginning!

Another study — a more comprehensive one — was conducted by The Cowen Group.

Cannabis sales will soon top $76 billion!

– The Cowen Group

It predicts that cannabis sales will soon blast through the $76 billion barrier.

And in a fifth study — by an analyst for Jeffries, a major Wall Street investment bank – says cannabis revenues will ultimately surpass $130 billion.

Cannabis revenues will ultimately surpass $130 billion!

– Jeffries Investment Bank

That’s about as much as Google makes in a year!

But still — even that $130 billion number may turn out to be wildly conservative.

According to United Nations data, total legal cannabis revenues are already closer to $142 billion.

Cannabis revenues are already closer to $142 billion!

– The United Nations

And a seventh study on the growth of the cannabis industry — this one, by Merrill Lynch — says, quote, “A $166 billion industry is now emerging from the shadows.”

“A $166 billion industry is now emerging from the shadows.”

– Merrill Lynch

$166 billion!

That’s nearly as big as America’s entire agricultural sector!

Farmers make more money on cannabis than on vegetables, wheat, cotton, grapes, apples, rice, oranges, tobacco and sugar beets – COMBINED!

Now think about what that means:

Last year, the cannabis industry’s revenues were a little over $10 billion.

But Merrill says it’s about to become a $166 billion industry.

Cannabis revenues could soon be 17 times larger than they are today!

– Merrill Lynch

The average cannabis company could soon be making nearly 17 times more money than it does today.

… And we’re already seeing profits of up to 4,627%!

And as a shareholder and part-owner of these companies, you could be, too!

And there’s an even more compelling reason why every serious investor should invest in cannabis today.

Millions of brand-new customers for medical and recreational cannabis could be mere weeks away from driving these stocks to explosive gains.

The Election Year Profit Multiplier

Marijuana stocks almost always post their biggest profits just before and immediately after national elections.

In 2014 for example, only four states had cannabis on the ballot. And according to Bloomberg …

… Lexaria Bioscience — a firm that specializes in producing healthy administration methods for cannabis-based pharmaceuticals – posted a 1,575% gain in about 60 days, leading up to the elections.

Plus, GB Sciences jumped 1,775% in four days …

And Zoned Properties soared 6,365%.

You could have invested $2,500 on January second and walked away on March fifth with $160,000.

That’s a clear profit of $157,500 in just over two months.

In the last presidential election cycle — 2016 – eight states had cannabis on the ballot …

Kona Gold Solutions posted a 1,072% gain in about two and a half months …

Freedom Leaf jumped 1,198% …

And CV Sciences soared 1,801%.

… All because these are CANNABIS stocks … these were ELECTION years … and Marijuana legalization was on the ballot.

Plus, in the election year of 2016, Novus Acquisition and Development soared 22,067% in about seven months.

That’s enough to turn a $2,500 grubstake into $554,000.

More than a half-million dollars.

Now, I know what you’re thinking.

A 22,000% profit is pretty much unheard of in the investment world.

That’s got to be the biggest profit ever made with cannabis stocks — right?

Before you answer, check this out:

In the election year of 2012, THC Therapeutics posted a 29,018% gain.

THC Therapeutics stock soars 29,000%! Turns every $2,500 invested into $727,545!

You could have invested $2,500 on January 17 and walked away on March 15 with $727,545.

That’s a clear profit of nearly three-quarters of a million dollars in less than two months.

Mainly because it was an election year.

And this time around, cannabis legalization is headed for the ballot in TEN states — more than ever before.

Idaho is considering a measure legalizing marijuana for medical use.

Legalization is headed for the ballot in 10 states this year!

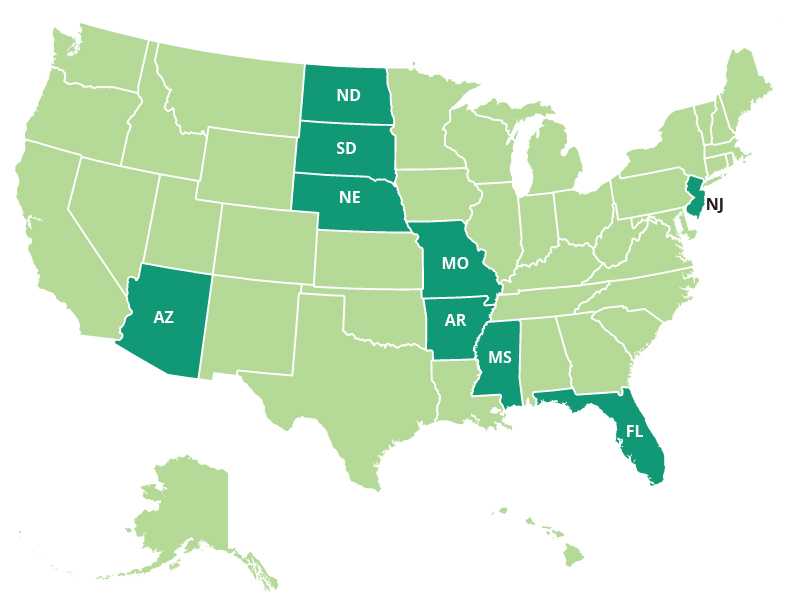

Meanwhile, recreational cannabis is heading for the ballot in Arizona … Arkansas … Florida … Mississippi … Missouri … Nebraska … New Jersey … North Dakota … and South Dakota.

That’s important: Until now, most states only legalized weed for medical use.

But this time around, nine out of the ten initiatives headed for a vote on Tuesday, November 3 legalize RECREATIONAL marijuana.

And there are many times more recreational users than there are people who get prescriptions for medical marijuana!

But how do we know that these initiatives are likely to pass?

Because it’s what Americans want!

Two compelling reasons why full legalization is inevitable

According to The Gallup Organization, 66% of all Americans want marijuana to be 100% legal

66% of all Americans want cannabis legalized!

– The Gallup Organization

We also know that the politicians and bureaucrats who have demonized cannabis for generations are now desperate for legalization to happen in their states. Because they need the tax money!

Washington is $22 trillion in debt and running huge deficits every year.

But it’s not alone.

Almost every state in the Union is choking on debt and strapped for cash.

They’re “green” with envy — pun definitely intended — watching the billions of tax dollars Colorado, California and other states are collecting on legal cannabis.

Thanks to legalization, Nevada’s tax revenues surged to $69.8 million in 2018.

Oregon’s revenues jumped to $94.4 million.

Colorado banked $266.6 million in cannabis tax revenues.

California made $300 million.

And Washington state hauled in $319 million.

That’s just over $1 billion in cannabis revenues for these five states alone.

And that $1 billion is just the tip of the proverbial iceberg.

My point is simply this: Since the majority of voters and politicians WANT cannabis legalized nationally, you can bet your bottom dollar it WILL be legalized.

That means cannabis companies are looking at the largest influx of new customers, revenues and profits EVER!

And as we all know, success breeds success.

So millions of folks will see how much money cannabis is making us, then jump on the legalization bandwagon; adding more cannabis stocks to their portfolios.

And all this new demand can only drive cannabis stock profits sky-high.

… Like the profits of 6,365% … $22,067% … up to 29,018% we’ve seen in previous election years.

Of course, those were rare, extraordinary gains. But it gives you an idea of what is possible.

Because …

Every year, more Americans come to accept cannabis as the god-send it truly is.

Did you know there’s an order of nuns in Merced County, California who cultivate cannabis plants for just that reason?

The Sisters of the Valley earn $1 million a year growing cannabis and making healing products for people with serious health problems.

CNN ran a story on it. So did ABC, Fox and a lot of other news outlets.

Seems the nuns are earning around $1 million a year growing weed to help people who are suffering.

The nuns make salves, lotions and tinctures for people on chemotherapy … for folks with epilepsy and arthritis … and also for people who need help with anxiety and depression.

So when you invest in cannabis, you’re doing well by doing good!

And you’re also in the best of company.

Did you know that George Washington was a cannabis investor?

Horticulturist Dean Norton is growing cannabis on George Washington’s Mount Vernon estate for the first time in 200 years.

It’s absolutely true! He bought the seeds, cultivated the plants and sold them for a profit.

He grew hemp, which is a strain of cannabis, for the fiber in the plant’s stalk. And he made money selling it to companies that made rope and that manufactured canvas sails for tall ships.

And in 2018, the federal government legalized the cultivation and growth of hemp cannabis for specific uses nationwide.

So now, for the first time in many decades, cannabis is once again being grown at Mount Vernon!

And George wasn’t the only historical figure who appreciated the cannabis plant.

The Egyptian Pharaoh Ramses the second likely used marijuana nearly 3,000 years before George Washington was born. Archaeologists even found cannabis pollen in the remains of his mummy!

Plus, more than 1,000 years before Christ, Greek writers extolled the virtues of using cannabis to treat tape worms, nosebleeds, ear infections and more.

William Shakespeare left a stash of clay pipes containing marijuana residue at his home in Stratford-Upon-Avon.

Founding Father James Monroe wrote a book about the advantages of cannabis and continued to indulge until his death at the ripe old age of 73.

In the late 1800s, the British regent’s private physician Sir J. Russell Reynolds prescribed marijuana to help ease Queen Victoria’s menstrual symptoms.

And several of John F. Kennedy’s biographers report that the president used marijuana to deal with his severe back pain in the late 1950s and early ‘60s.

One account even tells the story of JFK smoking three marijuana cigarettes with the famous artist, Mary Pinchot Meyer.

After the third joint, JFK supposedly said something like, “Whoa, DUDE! What if the Russians did something now!”

So when you invest in cannabis,

you’re helping a lot of people AND

you’re in the best of company.

More importantly, you’re positioned

to make a lot of money!

Like some of the extraordinary plays we’ve unearthed so far:

The 1,117% profit in Reliq Health … the 1,572% in Namaste Technologies … the 3,293% profit in THC Therapeutics … and the 4,627% profit investors could have made in PotNetwork.

Now, at this point, you’re probably wondering, “What’s this guy’s secret?”

After all: Other analysts love talking about cannabis stocks that post gains like these …

… But I don’t know anyone with a model this good: A model that actually recommends these stocks in time for you to grab your share of the profits!

The truth is, I have a secret weapon.

And you’re going to meet him right now.

His name is Martin D. Weiss, and he’s the founder and chairman of one of our great research institutions: America’s #1 independent stock ratings firm, Weiss Ratings.

Dr. Weiss founded Weiss Ratings in 1971 – nearly a half-century ago – as a reliable resource for investors looking for investment ratings that are 100% objective and free from any conflicts of interest.

Today, the Weiss Stock Ratings are respected around the world as the most fiercely independent and comprehensive rating service ever developed, covering more than 37,000 stocks and funds each and every trading day.

Let’s bring Dr. Weiss in now …

Martin — are you there?

Martin D. Weiss, Ph.D., Founder and Chairman, The Weiss Ratings

MARTIN: Yes! I’m here and I’ve been listening to everything you’ve said.

SEAN: Great. Please share with us some studies about the performance of your stock ratings.

Martin: You mean third-party studies or our own internal studies?

Sean: Both. But start with the third-party studies.

Martin: Let’s start with the great Wall Street Global Settlement. That was the massive settlement after the SEC and the attorneys general around the country sued America’s biggest Wall Street banks and brokers like Merrill Lynch, JP Morgan Chase, Goldman Sachs and seven others.

They got sued by the regulators because their stock research was so corrupt — bought and paid for by the very companies they were rating. And as part of the settlement, they agreed to spend $450 million to buy third-party, independent ratings for their customers.

Sean: Like your ratings.

Martin: Yes, like the Weiss Ratings. The regulators sponsored a system that awarded the ratings business to independent research companies with the most accurate ratings. The more accurate your ratings, the more business you got.

Sean: So who got the most business in that system?

Martin: Weiss Ratings did.

Sean: Because your ratings had the best performance of all?

Martin: Yes. And later, the Wall Street Journal confirmed it. The Journal reported that we were ranked #1 among all major Wall Street banks and independent research firms. Our stock ratings outperformed the ratings issued by Merrill Lynch JP Morgan, Goldman Sachs, Citibank, Standard & Poor’s and every one of the 18 other research firms reviewed.

SEAN: Plus, your stock ratings have earned the ConvergEx Group Award for “first-rate recommendations and insights …”

The Jaywalk Best Stock Selection Award …

And the Independent Research Provider Performance Award for “exceptional investment recommendations that have proven to be enormously valuable to clients during these uncertain times.”

MARTIN: We’re real proud of those …

SEAN: As well you should be!

MARTIN: But the most comprehensive stats come from our own internal studies. Over the past 11 years, if you invested exclusively in stocks with the highest Weiss ratings, your portfolio could have outperformed the S&P 500 by 6.1 to one. More than six times over.

For every $1 you could have earned with the average S&P stock, you could have earned nearly $6 by always investing in our highest-rated stocks

Sean: Our audience has to be wondering what this has to do with cannabis stock investing …

MARTIN: Hah! Turns out, it has everything to do with it.

Want me to tell the story, Sean?

SEAN: Please do!

MARTIN: Several years ago, Sean announced that he wanted to begin recommending cannabis stocks for investment.

I was skeptical at first — cannabis was still illegal in most places. But I relented when Sean explained how the legal cannabis industry was growing and how much money we could help our subscribers earn.

So I agreed — and nothing could have prepared me for the shock I felt when I first saw how much money he was making for our subscribers.

His results had been terrific: Profits of 216% … 309% … up to 468% …

And that got me thinking …

If Sean can help subscribers make this much money with his one-man approach to finding profitable marijuana stocks …

How much MORE could they make if we combined Sean’s stock-picking talents with Weiss Ratings’ team of quantitative analysts?

So I did something really underhanded: I invited Sean to lunch!

SEAN: Hah! I never could turn down a free meal …

And for my part, I was FLATTERED that Martin noticed how much money my cannabis stocks were making.

MARTIN: At that lunch, Sean and I agreed to put his talents and ours together — to create the world’s first scientific model for identifying cannabis stocks that are about to soar. We combined Sean’s intuitive seven-step stock-selection strategy with Weiss Ratings’ massive streams of data and complex algorithms.

Sean: All told, you’re talking about months of work and a million dollars in costs.

MARTIN: Actually, more! But after exhaustive testing, we knew we had it: A model for cannabis investing that’s probably the most effective in the world today.

A SCIENTIFIC stock selection system — based largely on Sean’s winning seven-step strategy that identifies the highest-quality cannabis stocks on the market …

Plus, a SCIENTIFIC stock timing system that tells us WHEN to buy and WHEN to sell each one!

SEAN: But nothing could have prepared me for what happened when we tested our new cannabis stock scoring system.

Our system told us to buy InMed Pharmaceuticals, which rose 526% in value …

AgraFlora Organics, which posted a 597% gain …

Player’s Network, which jumped 783% …

Reliq Health, which soared 1,117%, and …

THC Therapeutics, which exploded 3,293% higher.

That’s enough to turn every $2,500 you invest into nearly $85,000.

SEAN: So before Weiss Ratings, our profits were 206% … 309% … up to 468% …

But when we tested the power of the ratings with my cannabis stock-picking strategy, we uncovered the potential for far greater profits. Now, we were looking at gains of 1,572% … 3,293% … up to 4,627%.

MARTIN: Yes! Those numbers give you a good idea of what the profit potential is, especially with the smaller cap companies. But to accurately evaluate our scoring system, we look at the data more comprehensively, more broadly. We also include more established cannabis companies, which cannot grow as dramatically as small caps.

SEAN: Plus, one more thing: In any investment program, there will always be some losing trades, which …

MARTIN: … which is why we include BOTH the winners AND the losers. That’s what our computer model always does. Still, after adding up all the winners and all the losers, we found our scientific approach to cannabis investing could have helped investors turn a $30,000 grubstake into $1.4 million in three years.

PLUS, beginning in year three, you could have even withdrawn $20,000 per month — and STILL made that $1.4 million.

That’s nearly 47 times your initial investment.

SEAN: And that includes ALL trades, both winners and losers!

Martin: Yes! That’s the OVERALL result of our testing based on nearly three years of history. Sean, I suggest you take it from here. Be sure to explain how average investors can use our Cannabis Stock Scores to go for these kinds of profits.

SEAN: Will do. Thanks for helping us out here, Martin!

MARTIN: My pleasure!

SEAN: So let’s take a closer look at the strategy I developed with the Weiss Ratings team — to give you the opportunity to begin cashing in on the cannabis boom right now; today.

7 Rules for Building Wealth with Cannabis Stocks

Rule #1:

Avoid Growers!

For starters — this is going to surprise you — we seek out companies that do NOT make most of their money growing cannabis.

I know — it sounds crazy. Going for millions of dollars in cannabis profits by avoiding marijuana growers seems weird.

But there’s a method to our madness.

You see, given proper amounts of sunshine, water, fresh air and nutrients, virtually ANYONE can grow cannabis plants.

That’s great for farmers – not so great for investors.

Because as more growers enter the business, there will soon be more cannabis on the market than can be sold at current producer prices.

Cannabis will become a common commodity. And growers will have no choice but to cut prices … and cut their own profits … just to compete.

In fact, USAToday is reporting that, in some states, marijuana prices have already begun to fall.

Pot prices plunge 41%!

– USAToday

That’s not good for corporate earnings and it’s pure poison for investors.

But this is where it gets interesting.

Because some growers also process the cannabis they produce. They turn it into valuable products.

So it’s OK with me if a company grows cannabis, as long as it’s only a small part of their business.

Based on this, we developed a way to give every company I follow a Cannabis Diversification Score.

Since anybody can grow marijuana, the stock of growers is likely to plunge. Avoid them at all costs!

And since we want to own companies that don’t get a significant portion of their revenues from growing cannabis, I’m looking for the companies with the highest Cannabis Diversification Scores.

In a moment, I’ll give you the names of the three companies that have earned our highest Cannabis Diversification Scores.

Like my top choice for pot stocks with extremely valuable patents.

It’s the company that has a powerful patent on a drying process for cannabis — a process that dehydrates flower faster, better and cheaper than other methods.

Where others process cannabis in 5 to 7 days …

This company’s patented product does it in less than two hours!

Every cannabis grower and processor needs this company’s technology and they’ll pay dearly to get it. And with the number of growers and processors soaring in preparation for the upcoming elections, this stock is destined for greatness.

It has already demonstrated its ability to skyrocket in value, generating a 688% profit for investors. Now, after a healthy pull-back, it’s ready for its next run … and we’re going to be there every step of the way.

This company and the top cannabis companies in all seven of the categories I score are all profiled for you in a brand-new report I’m releasing today: My Cannabis Stock Scoreboard — and in a moment, I’ll give you a copy.

In Cannabis Stock Scoreboard, I NAME the cannabis stock that has earned our highest Cannabis Diversification Score …

PLUS I also name the stocks that have earned a place as our top picks in each of the six other areas I look at.

So you can begin going for triple-digit profits right away.

In the meantime though, let’s look at the second criterion I use to find stocks that can give you such huge gains.

Rule #2:

Favor Medical Marijuana Companies

It’s called our Pharma Tech Score — and it’s absolutely critical when it comes to maximizing your profit opportunities.

Because given all the healing properties of cannabis, marijuana-based medicines could ultimately replace a big chunk of the $1 trillion pharmaceutical industry.

And because medical marijuana is now legal in 33 states and the District of Columbia as well as Canada — you may not have to wait long to begin making money.

Your first profits could begin rolling in as early as next week!

Plus, each new prescription drug these companies develop is backed up by a strong patent to protect your investment.

And the number of U.S. cannabis patent holders has nearly tripled in the last three years:

Novartis has 26 patents for cannabis-based drugs.

Allergen has 29.

Roche has 46.

Bristol-Myers Squibb has 79.

Pfizer has 93.

Merk has 104.

And Abbvie has 154.

That’s 531 cannabis patents, held by just SEVEN major drug companies!

Plus, one Federal agency — the National Institutes of Health — has 23 patents for cannabis-based pharmaceuticals.

Another — the US Department of Health and Human Services — has 52 cannabis-based drug patents.

… Which, if you think about it, is kind-of a mind-blower.

The same federal government that still puts over 650,000 folks in jail for cannabis possession every year …

… is also handing out cannabis patents to rich drug companies — and to itself — like candy!

Seven major drug companies now hold 531 patents for cannabis-based drugs!

Three US universities — The University of Connecticut, Virginia Commonwealth University and the University of Tennessee – have a total of 93 patents between them.

Seven of Canada’s top 10 cannabis patent holders are major multi-national pharmaceutical companies.

And let’s not forget the newer, smaller pharmaceutical companies that do nothing but develop cannabis-based prescription drugs.

Take GW Pharmaceuticals, for instance. It’s hardly a mainstream drug company. Not a household name by any stretch.

But GW Pharmaceuticals has 117 patents on cannabis-based drugs that are now in clinical trials and should soon be FDA-approved and ready for sale.

Its drug called Epidiolex® is already approved by the U.S. Food and Drug Administration (FDA) for seizures associated with epilepsy.

And GW’s Sativex® — a multiple sclerosis drug — is now approved for sale and use in over 25 countries outside of the US.

Take a look at Zynerba, too! It has multiple cannabis-based drugs in the pipeline and one of them has been fast-tracked for development.

The company’s Zygel, now in clinical trials, is being developed to treat epileptic symptoms in children.

Man! All I can see is dollar signs, here.

The companies that own these patents are likely going to make BILLIONS of dollars!

And our Pharma Tech Score can guide you to the stocks that are likely to hand you the greatest profit opportunities.

In fact, it does four things extremely well:

First, it monitors how many drugs each pharmaceutical company has — or is about to have available.

Second, it looks at the types of products each company has and how large the market is for each one of them.

Third, it gives a higher weighting to companies that already have approved drugs in the marketplace.

And fourth, it spotlights the “purest play” pharmaceutical cannabis companies out there …

… Companies that have a high ratio of cannabis-based products to other types of drugs.

In just a few minutes, I’ll make sure you get your free copy of Cannabis Stock Scoreboard — and the name of the medical marijuana stock that has earned our highest PharmaTech Scores.

All for free.

Rule #3:

Favor The Cannabis Stocks

Wall Street is Dying to Own

The next quality I want to see is institutional demand.

I want to own companies that Wall Street’s richest financial institutions are in a panic to get a chunk of.

And by “institutions,” I mean mutual funds, hedge funds, investment banks, big brokerage houses and more.

They have trillions of dollars to invest.

So they can pour billions of dollars into any stock they like, any TIME they like.

And that means the stocks THEY like could explode your wealth virtually without warning.

Plus, your money is relatively safer in these stocks.

Institutional investors are less likely to cut and run at the slightest whiff of trouble.

And that means we’re less likely to be blindsided by losses during periods of stock market volatility.

What’s more, inflows of institutional money mean the company has more cash on hand to survive difficulties and to grow – which means YOU could make a lot more money.

Take General Cannabis Corp, for instance. Institutions own only 0.15% of its shares.

Tilray is in better shape, with 10.1% of its shares held by institutions.

And Aurora Cannabis is better still, with 12.1% of its stock in institutional hands.

But now, take a look at GW Pharmaceuticals: A whopping 81.95% of its shares are owned by institutions.

That’s a huge vote of confidence from many of the best money managers on Wall Street!

And just look at what all that institutional money has done for GW Pharmaceuticals:

At one point, you could have bought all the stock you wanted for just $9 a share.

So 1,000 shares would have cost you just $9,000.

But now, even after a pull-back, the stock is trading at over $141 per share.

So those 1,000 shares are worth more than $141,000 today.

That’s a clear profit of over $132,000 — and a 1,467% return.

Now, you could just go to Yahoo Finance and do some of this research yourself.

But Yahoo Finance can only tell you how much of a stock is owned by each major financial institution.

It can NOT tell you whether institutional interest is rising or falling.

And that’s critical data: The last thing we want to do is to buy a cannabis stock that big institutions are LOSING interest in!

The good news is that we also have the data to determine HOW MUCH capital institutions are providing by way of stock purchases.

That’s a key number in estimating how fast the company may be able to grow going forward.

And you get the name of the cannabis stocks that has earned our highest Institutional Demand Score in your free copy of Cannabis Stock Scoreboard!

Rule #4:

Favor Companies That Have Patents

on their Products and Processes

The fourth quality I look for in a great cannabis stock is patents.

Because drug companies aren’t the only firms that hold patents on cannabis processes and products.

In fact, the US Patent Office issued its first cannabis patent almost 80 years ago; in 1942.

And there are about 500 patented cannabis products out there today.

Patents are critical because anyone can grow cannabis. Anyone can harvest it, process it and sell it as something useful.

So theoretically at least, if you own a cannabis company, just about anyone could go into competition with you.

That can potentially crimp revenues … slow down profit growth … and hold back stock prices going forward.

And that’s definitely no way to get wealthy!

Patented products make bigger profits likely. Plus, a US patent can give a company global reach – and exposure to millions more potential customers.

But patents protect these companies from direct competition.

So the more patents a company has, the more secure its revenues and profits are!

Patented products make bigger profits likely. Plus, a US patent can give a company global reach – and exposure to millions more potential customers.

Did you know US patents help protect American companies in over 170 other countries? It’s a fact.

And patents can cover just about anything:

- Software to control grow rooms.

- Unique approaches to hemp processing.

- Delivery systems for CBD oil, a nearly universal healer … and also for THC, the main psychoactive element in cannabis.

Charlotte’s Web Holdings even offers patented hemp-based CBD for pets.

Tilray recently applied to patent methodology to kill microbes on the cannabis plant. And they’re doing that without compromising quality.

Aurora Cannabis has a series of patents covering everything from extraction of THC to pharmaceuticals.

The Yield Growth Corporation has 11 patents protecting the production and use of its hemp root oil in everything from medicines to make-up.

And plenty of non-cannabis companies are patenting marijuana-based products, too.

Like Coca-Cola as well as beer brands like Heineken … Guinness … Corona and more.

In your free copy of my Cannabis Stock Scoreboard, I NAME the marijuana stock that has earned our highest Patent Score.

This could save you a lot of time and effort, not to mention, help multiply your cannabis profits up to ten times over.

And it’s all yours for the taking.

Rule #5:

Favor Companies

That Use Microencapsulation

The next score I use to identify profitable cannabis stocks applies only to companies that produce EDIBLE cannabis products — like marijuana cookies and brownies.

Walk into any dispensary and you’ll see a mind-blowing variety of candies like chocolate bars and pot pops …

Cannabis edibles are the obvious choice for people who worry about the effects of smoking.

Plus gummy bears, marshmallows and many other confections.

They even make cannabis-infused beef jerky for snacking!

You can quench your thirst with cannabis-infused coffees, teas and soft drinks and even tinctures to add a little kick to your daily water intake.

You can even buy cannabutter for your toast, pancakes and baked potatoes – or to prepare a thousand different cannabis infused foods at home.

But there’s a problem.

The problem is, it takes up to two hours for cannabis edibles to take effect.

And because you never know exactly how long it’s going to take, it’s easy to get higher than you expected.

The great news is, edibles makers already have a way to speed up the process.

It’s a process called “microencapsulation” — and companies that have this technology are going to own the edibles market because it makes using edibles more predictable and faster-acting.

In other words, it makes cannabis edibles perform more like a double shot of Scotch would.

For example: A company named 1906 — a Colorado-based edibles-maker — uses microencapsulation to develop “rapid delivery” edibles.

They take effect in 15 to 20 minutes — up to 8 times faster than ordinary edibles.

The company’s founder, Peter Barsoom, says, “Our competitors are chardonnay, Xanax and coffee. — NOT other edibles.”

POTNetwork Holdings has a different process, called CO2 extraction, for use with CBD oils. And since CBD is already legal for sale in all 50 states, this is an immediate profit opportunity.

Plus, NABISCO — the maker of Oreos — is already developing this technology, even as I speak.

Companies like 1906, PotNetwork and Nabisco with rapid-delivery technology are the future in the edibles industry.

And in your free copy of Cannabis Stock Scoreboard, I NAME the company that has earned the coveted spot at the top of my list.

Rule #6:

Favor Companies that Specialize

in Hemp and CBD Production

The SIXTH score I use to identify today’s most profitable pot stocks really has nothing to do with THC or getting high.

And it has everything to do with a completely different use of the Cannabis Sativa plant.

It’s hemp.

Hemp has been around for ages.

According to The Columbia History of the World, the oldest relic of human industry is a scrap of hemp fabric dating back to approximately 8,000 BC.

Today, it’s used to make a lot more than just rope:

It’s used in textiles, shoes, paper, insulation, biofuel, mulch, animal bedding, cat litter, lubricants, ink, varnish, paint.

It’s also a secret ingredient in bread, granola cereal, protein powder, dressings, margarine, and more.

And recently, someone actually built an airplane out of hemp fiber!

His name is Derek Kesek — a Canadian entrepreneur — and the hemp airplane he built even runs on hemp ethanol!

But right now, the single most important use of hemp is to produce CBD oil, which, as I mentioned earlier, is an almost universal healer.

Users say it eases stress, anxiety and depression … relieves pain … reduces inflammation … improves sleep … enhances mental clarity … and more.

Physicians even use CBD oil from hemp to treat epilepsy, multiple sclerosis and other neurological disorders and to alleviate many symptoms of cancer and chemotherapy.

Derek Kesek, a Canadian entrepreneur, makes an airplane out of hemp fiber – and it even runs on hemp ethanol!

In other words, hemp is one big, fat cash cow.

And since both hemp and hemp CBD are now fully legal, your profit potential is both enormous and immediate.

So making sure the companies behind your cannabis stocks are also working with hemp and CBD can give you a huge advantage over other cannabis investors.

And now, we have our Hemp Score:

Companies that deal in hemp and CBD — products that are already legal in all 50 states get our highest score in this category.

Charlotte’s Web is a great example. It’s a hemp-focused company. So it gets a high Hemp Score from Weiss Ratings.

Now, if you insist on owning the stocks I name for you in the first six chapters of Cannabis Stock Scoreboard, I think you’ll be amazed at how much money they make you.

Rule #7:

Favor The Pot Companies

That Are Most Likely to Become

Takeover Candidates

And there’s one final factor I look at — and it could single-handedly multiply your profits many times over.

Because the cannabis industry is still in its infancy.

There’s a mad dash for growth.

And bigger companies have more than one way to grow.

In addition to selling more of what they produce, they can also buy growth.

By buying fast-growing smaller companies.

Stock of weed companies that are likely to be acquired by bigger companies can give you an extra profit kicker!

And if one of your stocks comes into play, it can light a keg of dynamite under your portfolio.

So the final quality I look at — our Takeover Score — is a huge profit kicker for us.

It identifies stocks of cannabis companies that have all “the right stuff” to be acquired — to be bought outright by another cannabis company.

And when I say, “The Right Stuff,” I mean stocks of companies that exhibit key characteristics that every sharp CEO needs to see in a company he plans to acquire.

That’s why the algorithm we designed to help us find the hottest takeover targets gives extra weight to companies with high enterprise value.

That’s the measurement of a company’s total value that other companies look at when deciding how much to pay to buy it.

It includes market cap, cash on hand and the amount of long-term and short-term debt the company is carrying.

But we didn’t stop there.

We add one more factor:

Forward Sales.

Because a company’s Enterprise Value may make it look attractive …

… But it’s really meaningless unless I can compare that value with the amount of revenues the company’s set to make in coming months and years.

So I’m looking for companies with lower Enterprise Values relative to Forward Sales.

Used to be, this took a lot of work. Toiling away over hot spreadsheets until my eyes were so bleary, I could barely read another number.

Now, thanks to the Weiss Ratings team, finding tomorrow’s most promising takeover candidates takes only seconds.

And like the six other scores we use to identify stocks that are most likely to soar …

Our Cannabis Diversification Score — that steers us away from growers that are likely to plunge in value and towards stocks more likely to lead the pack …

Our Pharma Tech Score — that guides us to companies with the most valuable patents on cannabis-based pharmaceutical drugs …

Our Institutional Demand Score — that identifies the cannabis stocks that have attracted the greatest amount of “smart money” from Wall Street institutions …

Our Patent Score — that spotlights non-pharmaceutical cannabis stocks with valuable patents on their products and processes …

Our Microencapsulation Score — that steers us towards companies with patents on rapid-delivery systems for edibles like cookies and brownies …

Our Hemp Score — that guides us to companies that are already posting huge profits in the 100% legal hemp and CBD sectors …

And finally, our Takeover Score — that identifies the cannabis companies with all the right stuff to be bought out, sending their stocks exploding higher.

And the proof is in the pudding: This strategy has allowed me to help everyday investors go for profits like these:

Village Farms: UP 535% …

Cronos Group: UP 601% …

Global Hemp Group: UP 953% …

Namaste Technologies: UP 1,572%, and …

PotNetwork: UP 4,627%; enough to turn every

$2,500 you invested into nearly $116,000.

And I want to give you FOUR valuable gifts to help each of you go for these kinds of profits every month from now on.

Here’s what you’ll need to go for profits of up to 4,627% in 2020 …

FREE Profit Guide #1:

Cannabis Stock Scoreboard profit guide

NAMES North America’s BEST Pot Stocks

— and it’s yours, FREE!

Your FIRST gift is a free copy of my Cannabis Stock Scoreboard — and it includes the names of the cannabis stocks that have earned the highest score in each of the seven areas I monitor.

And that’s just the first of seven.

So if you’re looking for great cannabis stocks with the right stuff to lead the pack in 2020 and beyond, look no farther — it’s all here for you:

This is where you’ll find my complete analysis on the company I mentioned earlier — the 688% gainer with a patented process that dries marijuana flower 84 times faster than conventional methods.

And that’s just the first of seven.

So if you’re looking for great cannabis stocks with the right stuff to lead the pack in 2020 and beyond, look no farther — it’s all here for you:

-

The ONE company that will benefit the most as cannabis flower is commoditized nation-wide. It provides extraction services that growers and processors can’t live without. I conservatively estimate we’ll be looking at a triple — at least — in the months ahead.

-

The pharmaceutical giant that’s bringing sweet relief to chemotherapy patients: Looking for a large, stable blue chip to round out your cannabis portfolio? Look no farther! My #1 pick in medical marijuana is one of the biggest.

Its patents on medical cannabis drugs are worth billions. And yet, it’s a big gainer; posting a 97% gain in a single 12-month period recently. Now, with recreational pot on the ballot in ten states plus D.C., I look for this stock to double, then double again in 2020 and beyond.

-

The tiny company that’s perfecting rapid delivery of thin wafers that are infused with cannabis compounds.

Instead of smoking the cannabis, you simply place the wafer under your tongue. The fascinating thing is, every pharmaceutical company in the world is going to want to offer these pleasant, easy to use and fast-acting wafers.

This top-rated cannabis stock reminds me a lot of cannabis stocks that soared 10x or more in the last elections.

So if you’re looking to put a little bit of money to take a flyer on one higher risk cannabis stock, this is the one I recommend.

And your free copy of my Cannabis Stock Scoreboard is only the beginning of FOUR powerful marijuana investing tools I have for you.

FREE Profit Guide #2:

Massive profits ahead in HEMP!

You also get a free copy of our profit guide for hemp and CBD: Hemp Wars!

That’s my answer to the question, “who will win the race to become America’s most profitable hemp and hemp CBD company?”

This is a critically important answer to have for two key reasons.

First, the federal government has already legalized the growth and processing of hemp …

And all the publicity around cannabis legalization already has millions of Americans trying CBD oil and other hemp-based products.

… And that means you won’t have to wait to begin seeing huge profit potential. You can begin going for triple-digit profits – and even quadruple digit profits — immediately!

For starters, you’ll discover the little-known law — passed just a few months ago — that makes it legal to grow and sell cannabis plants for hemp and CBD production.

And how CBD sales are now doubling every year.

I’ll introduce you to my top-rated hemp and CBD stock now …

It’s already a global leader in this market and is nearly tripling the acreage dedicated to hemp production … is DOUBLING the amount of hemp and CBD it produces every year … and is also doubling its sales annually.

I look for this stock at least double — and possibly triple — in the run-up to the 2020 elections.

Plus, I’ll also introduce you to an intriguing runner-up for the “Best CBD Stock” title.

It’s a $187 million life sciences company that focuses on developing medicines using synthetic CBD. Its drug division focuses on developing pharmaceuticals, while its consumer division produces CBD products in the health and beauty niche.

The company recently announced plans to increase its production capacity by 500%, with a new 45,500-square-foot facility.

Sales are soaring at the rate of 36% per year and has nearly $16 million in cash on hand.

Plus, the stock pays a nice dividend, and it’s expected to jump to 11 cents per share in 2020 — a 371% increase.

And then, it should more than double again in 2021 to about 26 cents per share.

As far as the share price is concerned, I’m looking for a solid triple-digit gain between now and the end of 2020.

FREE Profit Guide #3:

The 14 Pot Stocks that Wall Street’s Richest Investors are Dying to Own

You get the fourteen stocks that Wall Street’s richest investors and institutions are ploughing the most money into.

The best minds in the stock market are betting everything on these companies.

They have put their money where their mouths are — by investing billions of dollars in these companies.

What’s more, each of these companies now has enormous “street cred” — endorsements from the best minds on Wall Street.

And that means, each of these companies has access to special deals and other opportunities their competitors don’t.

More importantly, it means that each of these companies is flush with cash to get through slower times … and also for expansion, including the acquisition of other cannabis companies.

In fact, if I had to pick an all-star “dream team” of cannabis stocks, every one of these 14 companies would be on it!

I look for each of these companies to lead the cannabis industry for the next decade, with the potential for AT LEAST triple-digit profits — and in this election season, much more!

FREE Profit Guide #4:

The world’s #1 Cannabis stock:

Buy it now for massive profit potential in 2020

Plus, I have a FOURTH profit guide for you:

It’s my brand-new volume, The “Apple Computer” of Cannabis!

Looking for a marijuana stock you could fall in love with?

Something you can buy today, then confidently hold through thick and thin?

A stock you could reasonably count on to deliver four-digit and even five-digit profits over the long haul?

Well, I’m pretty sure I found it, but you’ll have to be the judge.

It’s all in your FREE copy of The “Apple Computer” of Cannabis!

This is the ONE company that has everything it needs to dominate the cannabis industry. It’s already a monster compared to its competitors — with a market cap of over $223 million.

This firm has developed the concept of “marijuana superstores” that are designed to be destinations, much like Apple’s stores.

It already has one of the world’s most spectacular dispensaries, A Las Vegas establishment boasting over 16,000 square feet of retail space … 42 cash registers … and deals with over 1,000 customers per day.

Plus, it recently purchased a dispensary in Orange County, California, just ten minutes from Disneyland, with 18 million visitors per year — and many other locations are now in the planning phase.

In addition, the company just completed construction on “Phase II” of its massive Las Vegas store, adding a restaurant, café, event center and customer-facing production facility. The restaurant opened on October 11th. There will also be a tasting room for marijuana-infused beer and wine and a lounge for consuming marijuana on site when that is legalized.

And because its lavish superstores are becoming destinations, the company can literally charge DOUBLE for most of the stuff it sells.

As a result, quarterly revenues are nearly QUADRUPLING every 12 months. In fact, they were up 275% in a recent three-month period!

Plus gross profits are soaring at the rate of 333% year over year.

And if that isn’t enough, the company is putting every penny it makes — and more — into expansion. And it also has $20 million in cash available for growth.

For all these reasons and more, I believe that just as Apple Computer has become the largest company in the electronics computer sector, this firm will soon become the 800-pound gorilla of the cannabis industry.

And I name this stock for you — and give you all the details you need to go for profits — for free in your complimentary copy of The “Apple Computer” of Cannabis!

And if you want to

MAXIMIZE your cannabis profits,

you’ll need just one more thing:

You’ll also need a steady stream of updates to our Cannabis Stock Scores plus my “buy” and “sell” signals for every marijuana stock I follow.

That’s where Wealth Megatrends, my monthly investing newsletter, comes in.

For those of you at home who are not yet subscribers, you will definitely want to take a look.

In every issue of Wealth Megatrends, I make sure you have the freshest data available on these cannabis stocks.

And to make this so easy a child could do it, I also give you my #1 trade of the month — I tell you precisely what to buy and how much to pay.

And when it’s time to take your money off the table, I rush you an urgent Trade Alert.

Sometimes of course, a profit opportunity appears between regular monthly issues of Wealth Megatrends.

And when that happens, I fire off a special email with full instructions.

So you get an average of two cannabis trades every month:

Two trades that take only seconds to make …

Two trades with the power to turn every $2,500 you invest into as much as $160,000 — and probably a lot more — as we approach election day.

SAVE $260 TODAY!

Now at this point, you’re probably wondering how much all of this is going to cost you.

Normally, you’d probably expect to pay at least $299 for an investment newsletter with the power to multiply your investment up to 47 times over.

But if you join me today, during this Special Introductory Period, you won’t have to pay anywhere near that much.

Due to the vast profit opportunity now available to cannabis investors — especially with the 2020 elections now on the horizon …

And also to help you see for yourself just how profitable our scientific cannabis stock investing system can be …

I’m making it possible for you to subscribe to Wealth Megatrends — and claim free copies of …

My Cannabis Stock Scoreboard …

Hemp Wars …

Wall Street’s Fast 14 …

and The Apple Computer of Cannabis …

… all for just $39.

A single click is all it takes to add Wealth Megatrends to your order for just $39. You’ll SAVE $260 on your one-year subscription and receive your FREE copies of Cannabis Stock Scoreboard … Hemp Wars … Wall Street’s Fast 14 … The “Apple Computer” of Cannabis … and MORE!

You SAVE $260 off the normal $299 price by subscribing to Wealth Megatrends now.

Your satisfaction is absolutely GUARANTEED:

And I give you my word: Your $39 is safe with me.

I’ll gladly send it back to you if you ever decide you’re less than thrilled with the money I make you.

Simply click the button below to subscribe now.

A single click is all it takes to add Wealth Megatrends to your order for just $39. You’ll SAVE $260 on your one-year subscription and receive your FREE copies of Cannabis Stock Scoreboard … Hemp Wars … Wall Street’s Fast 14 … The “Apple Computer” of Cannabis … and MORE!

Then, take as long as you like to decide if Wealth Megatrends is for you. If not, just let us know in your first year on-board and I’ll rush you a full refund.

I’ll also insist that you keep your free copies of Cannabis Stock Scoreboard … Hemp Wars … Wall Street’s Fast 14 … AND The “Apple Computer” of Cannabis!

It’s my way of thanking you for giving me the chance to help grow your wealth.

The intriguing question

every serious investor

needs to ask now:

Normally at this point, you’d expect me to tell you how much all of this would usually sell for.

And you know, we could play that game …

Because each of these four reports would normally sell for $79.

That makes your free gift bag worth well over $316.

That alone is nearly ten times today’s heavily discounted price for Wealth Megatrends.

But I’d rather ask a very different question:

“What would it be worth to you to own stocks that soar even more dramatically

in this election year?

“… Or that could multiply your money up to 47 times over even in non-election years?

… Or that could generate extra income of up to $20,000 per month for you?

… Or, if you reinvest your profits, could turn every $30,000 you invest into more than $1.4 million?

I think I know the answer — but the great news is, if you join me today … you won’t have to give the price a second thought.

You pay just $39 for a scientific system that identifies cannabis stocks that are about to triple your money or more.

You get all four cannabis investing guides: Cannabis Stock Scorecard … Hemp Wars! … Wall Street’s Fast 14, and … The “Apple Computer” of Cannabis — at no cost …

… Plus a full year of updates including specific “buy” and “sell” signals for cannabis stocks in our Wealth Megatrends newsletter …

A single click is all it takes to add Wealth Megatrends to your order for just $39. You’ll SAVE $260 on your one-year subscription and receive your FREE copies of Cannabis Stock Scoreboard … Hemp Wars … Wall Street’s Fast 14 … The “Apple Computer” of Cannabis … and MORE!

And I have one more present for you;

— probably the most valuable gift of all.

It’s my Cannabis Investor’s Election Year Guide for 2020.

In your free copy of Cannabis Investor’s Election Year Guide, I give you a comprehensive history of the profits my favorite cannabis stocks have posted in election years.

I explain why those profits could be dwarfed by the money that will be made in the year ahead.

I document the types of stocks that soared the most in previous election cycles …

And I even help you get your timing right — when to get into the market — and out again — to lock in maximum profit potential …

PLUS, I give you specific recommendations on THREE must-have election-year cannabis stocks …

The same kinds of stocks that have soared up massively in previous election years.

It would be crazy NOT to own these election-year must-haves now!

A single click is all it takes to add Wealth Megatrends to your order for just $39. You’ll SAVE $260 on your one-year subscription and receive your FREE copies of Cannabis Stock Scoreboard … Hemp Wars … Wall Street’s Fast 14 … The “Apple Computer” of Cannabis … and MORE!

Election-Year Must-Have #1:

-

Revenue TRIPLING every year

-

Doubling the number of compounds it extracts from plants

-

Strong balance sheet – $50 million in cash

The first recommendation in your FREE copy of The Cannabis Investor’s Election Guide for 2020 makes most of its money extracting cannabis concentrates from dried cannabis flowers.

In fact, the company has extraction agreements with big names including Tilray, The Green Organic Dutchman, HEXO and more.

Its cannabis extraction is up 376% year over year, and revenue soared 296% year over year to $8.8 million.

Extracting cannabis concentrates is big business — UP 376% per year!

The company is now in the process of DOUBLING the amount of cannabis compounds it can extract from plants.

And it’s also carving out an exciting future for itself, billing itself as a biotechnology firm that engages in scientific research on cannabis products.

Plus, its balance sheet is strong – with cash and short-term investments of approximately $50 million at the end of the quarter.

Election-Year Must-Have #2:

-

#1 CBD seller in North America

-

7,000 retail locations in 22 states

-

Net income of $11.8 million; 12 cents per share!

-

$73 million in cash on hand

-

Growing like mad: Revenues UP 12 times in three years!

The second election-year must-have in your free copy of The Cannabis Investor’s Election Guide for 2020 is also a play on the booming market for CBD oil.

Investment bank and financial services firm Cowen & Co. estimates that 2018 sales of CBD ranged between $600 million to $2 billion and forecasts this number to rise to $16 billion by 2025.

Election Year Must-Have #2 is North America’s #1 in hemp-based CBD seller.

Cash in on the CBD Revolution with this election year windfall stock!

Its products are sold through 7,000 retail locations, including five mass retailers in 22 states. Krogers is just the most recent retailer to start carrying its topical products.

But this is much more than just another CBD company. It generated $11.8 million of net income in 2018, or 12 cents a share!

Plus, the company has $73 million in cash and gross margins are a healthy 75%.

A 100 milliliter bottle of CBD oil recently retailed for $189 on the company’s website.

And the company is growing like mad: Revenues were only $14 million in 2016. This year, they’re expected to be as much as $170 million. That’s TWELVE TIMES MORE!

Election-Year Must-Have #3:

-

CBD products producing income and profits NOW …

-

Revenues increasing 409% per quarter …

-

$231 million in cash on hand …

-

Massive expansion underway — 19 states, 19 dispensary licenses, 26 processing facilities and more …

Finally, the THIRD election-year must-have in our Cannabis Investor’s Election Guide for 2020 is a company that’s positioning itself to become one of the world’s largest cannabis firms.

The company markets its CBD products through its own retail stores and also through CVS Health.

It’s already growing by leaps and bounds. Company revenues are now on track to hit $350 million and they’re increasing at the rate of 409% per quarter!

Top election-year pic: 409% growth!

Here’s another big plus: A new acquisition that closes in 2020 will expand the company’s presence from 12 to 19 states … give it 131 dispensary licenses, 68 operational locations, 20 cultivation sites and 26 processing facilities.

And on top of all that, the company has $231 million in cash and less than $35 million in total liabilities.

Thanks to the election, I realistically see this stock blowing away previous election year records for cannabis stocks.

A single click is all it takes to add Wealth Megatrends to your order for just $39. You’ll SAVE $260 on your one-year subscription and receive your FREE copies of Cannabis Stock Scoreboard … Hemp Wars … Wall Street’s Fast 14 … The “Apple Computer” of Cannabis … and MORE!

So now, I have a question for you …

What on Earth are you waiting for?

As Benjamin Franklin famously said, “You may delay, but time will not.”

With Election day 2020 bearing down on us, there’s no time to waste.

Every day you go without these stocks in your portfolio could mean thousands of dollars in lost opportunity.

And all you have to do is click the button below.

A single click is all it takes to add Wealth Megatrends to your order for just $39. You’ll SAVE $260 on your one-year subscription and receive your FREE copies of Cannabis Stock Scoreboard … Hemp Wars … Wall Street’s Fast 14 … The “Apple Computer” of Cannabis … and MORE!

You gave us your ordering information when you bought The Cannabis Investor’s Bible …

So one quick click of your mouse and you’re in!

And I’ll send you the link to download all five of your free cannabis profit guides mere seconds after you subscribe.

I’ll close with the same quote I used to begin today:

Confucius once said, “The Gods cannot help those WHO

FAIL to seize great opportunities.”

Your Great Opportunity is now laid out before you.

Just waiting for you to seize it.

I think you know what to do.

Thanks for watching.

A single click is all it takes to add Wealth Megatrends to your order for just $39. You’ll SAVE $260 on your one-year subscription and receive your FREE copies of Cannabis Stock Scoreboard … Hemp Wars … Wall Street’s Fast 14 … The “Apple Computer” of Cannabis … and MORE!